When businesses fall into receivership the responsibility for liquidated property assets transfers to the appointed insolvency practitioner. There is an urgent requirement to secure the vacant site, ensuring insurance cover is maintained and the market value preserved until the assets are sold or re-let.

FRG provide rapid, insurance approved advisory and delivery of security, fire and facilities management solutions to protect and maintain vacant properties on behalf of Restructuring and LPA, Corporate Recovery, and Fixed Charge Receiver clients nationwide.

Insurance compliance management

Our dedicated risk experts ensure your distressed asset insurance and regulatory obligations are met in the most efficient and cost-effective way possible. We have extensive experience and knowledge working with UK insurance providers and recommend risk reduction measures in line with insurance industry compliance requirements.

Free, no obligation risk assessments

We conduct detailed site risk assessments following the best practice of NARA (The Association for Property and Fixed Charge Receivers) and the IPA (Insolvency Practitioners Association) to deliver reliable and realistic risk mitigation advice.

Insolvency services we offer include:

- Immediate security cover if required

- Emergency boarding up

- Security doors and window screening

- CCTV and alarms

- Temporary fire protection

- SIA licensed security officers and canine teams

- Utilities services

- Void property inspections

- Keyholding & alarm response

- Perimeter protection

- Cleaning services and property clearance

- Property Guardians

- Eviction services

- Asset management – Maintenance, repairs and FM services.

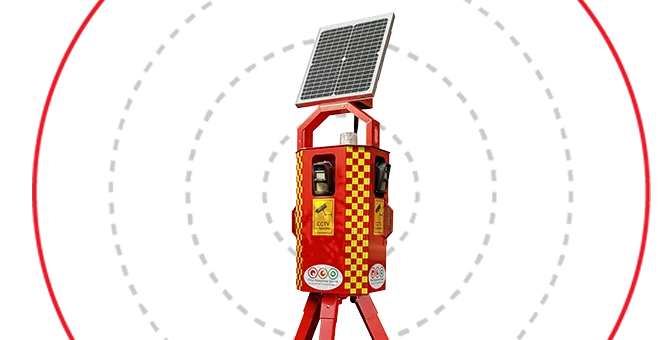

Featured Service

DetectPlus M-PIDS: Mobile Perimeter Intruder Detection

Redefining rapid deployment temporary surveillance for your construction site, vacant property or event. Find out more.

or call 0330 124 6019